Our Favorite Dividend ETFs for 2012

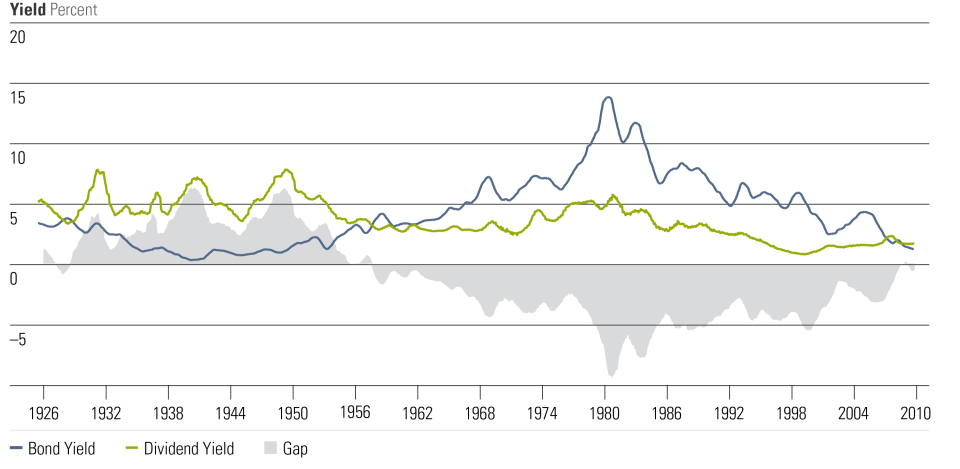

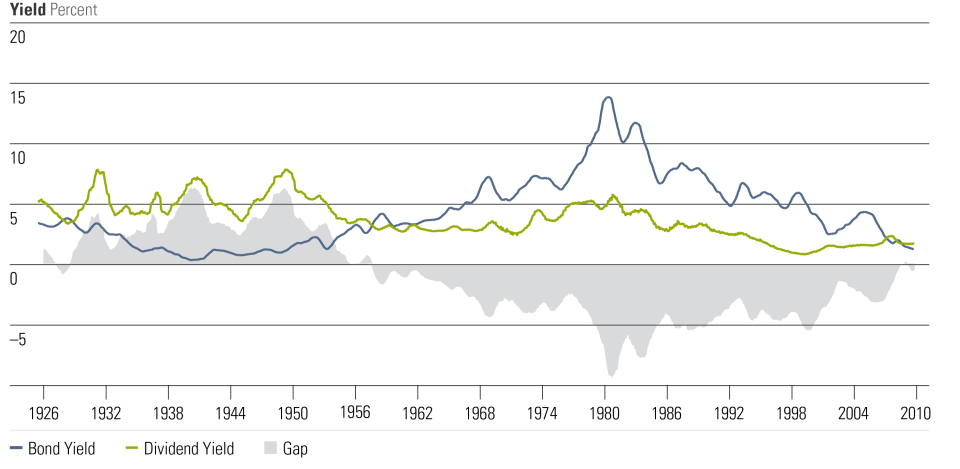

With bond coupon rates at historic lows, investment categories that offer alternative sources of yield have been among the most popular over the past couple of years. We see this trend continuing into 2012 and feel that investors should take comfort in the academic evidence supporting dividend investing and the total return approach.Since 1927, high-dividend-paying stocks have returned 11% per year, beating the 8% return from nonpayers and resulting in an ending wealth that is 8 times larger. Better yet, they accomplished this feat while incurring less volatility. But dividend-paying stocks outperform only over the long haul, so why might 2012 be a particularly good year for dividend-paying stocks? First, stocks offer a better relative value than bonds. Second, large-cap quality stocks are selling at a discount compared with riskier small-cap stocks. Unlike small caps, large caps have the capacity to withstand continued slow economic growth. Source: Kenneth FrenchStocks are reasonably priced relative to bonds. In the four years prior to the start of the financial crisis in October 2007, investors poured $875 billion into stock exchange-traded funds and mutual funds. Stock funds captured 50% of each dollar invested. But in the four years since, investors have avoided stock funds, instead putting 98% of all fund flows into bond funds. That severe risk aversion has led stocks to appear attractive relative to bonds. In fact, the yield differential between the 10-year government bond and the dividend yield on the S&P 500 has not been this attractive since the 1950s. At that time, we were coming out of a period in which the Federal Reserve pegged interest rates at artificially low levels to help the government fund World War II. In the 30 years prior to 1980, the S&P 500 returned 6% per year after inflation compared with negative 2% from long-term government bonds.

Source: Kenneth FrenchStocks are reasonably priced relative to bonds. In the four years prior to the start of the financial crisis in October 2007, investors poured $875 billion into stock exchange-traded funds and mutual funds. Stock funds captured 50% of each dollar invested. But in the four years since, investors have avoided stock funds, instead putting 98% of all fund flows into bond funds. That severe risk aversion has led stocks to appear attractive relative to bonds. In fact, the yield differential between the 10-year government bond and the dividend yield on the S&P 500 has not been this attractive since the 1950s. At that time, we were coming out of a period in which the Federal Reserve pegged interest rates at artificially low levels to help the government fund World War II. In the 30 years prior to 1980, the S&P 500 returned 6% per year after inflation compared with negative 2% from long-term government bonds. Source: Morningstar AnalystsWithin stocks, we prefer large-cap and low-risk stocks to smaller-cap or pricier stocks. Economic growth will likely remain subpar, so we want to avoid high beta stocks and those pricing in an expectation for rapid growth. But even with slow growth, dividend-paying stocks should be able to maintain their payouts. Payout ratios are below their historical average, so firms could boost payouts to maintain the dollar amount of payouts. In addition, firms have built a sizable cash buffer, which could be used to increase payments. Companies in the S&P 500 have cash equivalent to $296 per index unit, compared with an index level of 1,250. Net debt per unit has dropped from $1,058 at the end of 2007 to $470 today. In other words, if we enter another recession, companies are much better prepared to handle it.With that investment thesis in mind, here are some of the funds that we recommend as well as a few high-yielding funds we might avoid.

Source: Morningstar AnalystsWithin stocks, we prefer large-cap and low-risk stocks to smaller-cap or pricier stocks. Economic growth will likely remain subpar, so we want to avoid high beta stocks and those pricing in an expectation for rapid growth. But even with slow growth, dividend-paying stocks should be able to maintain their payouts. Payout ratios are below their historical average, so firms could boost payouts to maintain the dollar amount of payouts. In addition, firms have built a sizable cash buffer, which could be used to increase payments. Companies in the S&P 500 have cash equivalent to $296 per index unit, compared with an index level of 1,250. Net debt per unit has dropped from $1,058 at the end of 2007 to $470 today. In other words, if we enter another recession, companies are much better prepared to handle it.With that investment thesis in mind, here are some of the funds that we recommend as well as a few high-yielding funds we might avoid.  Vanguard High Dividend Yield Index ETF (VYM)

Vanguard has two funds on this list, and of the two, this one offers a higher yield and a large-cap-value tilt. It is low-cost and widely diversified, so it could serve as a core fund and will likely have a fair amount of overlap with your other large-cap funds. Despite industry practice, the "high yield" in the name is not a euphemism for junk--this is a Vanguard fund after all.

Vanguard High Dividend Yield Index ETF (VYM)

Vanguard has two funds on this list, and of the two, this one offers a higher yield and a large-cap-value tilt. It is low-cost and widely diversified, so it could serve as a core fund and will likely have a fair amount of overlap with your other large-cap funds. Despite industry practice, the "high yield" in the name is not a euphemism for junk--this is a Vanguard fund after all.  WisdomTree DEFA (DWM)

This is but one from a stable of high-yielding international ETFs from WisdomTree. This one weights firms by the amount of dividends paid, resulting in a large-cap-value tilt. While dividends are more common overseas, they are also a good check on corporate governance, particularly when investing in foreign markets where due diligence is more difficult.

WisdomTree DEFA (DWM)

This is but one from a stable of high-yielding international ETFs from WisdomTree. This one weights firms by the amount of dividends paid, resulting in a large-cap-value tilt. While dividends are more common overseas, they are also a good check on corporate governance, particularly when investing in foreign markets where due diligence is more difficult. PowerShares FTSE RAFI US 1000 (PRF)

This ETF is also not marketed as a dividend fund, but it incorporates dividend information, along with sales, book value, and cash flow. The result is a more stable approach than using dividends alone--after all, many top-performing companies pay no dividends at all. For example, VYM does not own any stock in

PowerShares FTSE RAFI US 1000 (PRF)

This ETF is also not marketed as a dividend fund, but it incorporates dividend information, along with sales, book value, and cash flow. The result is a more stable approach than using dividends alone--after all, many top-performing companies pay no dividends at all. For example, VYM does not own any stock in  Apple (AAPL). Of all the funds mentioned in the list, PRF is the most well-balanced core fund.

Apple (AAPL). Of all the funds mentioned in the list, PRF is the most well-balanced core fund. Vanguard Dividend Appreciation ETF (VIG)

VIG is a perennial favorite, and while this fund does not have a high yield, it earns points for stability. Firms in this fund need to increase dividends for 10 consecutive years, which limits exposure to more-cyclical industries. Firms with strong brand names and stable repeat businesses are often able to consistently grow dividends. Thus, it is little wonder that firms like

Vanguard Dividend Appreciation ETF (VIG)

VIG is a perennial favorite, and while this fund does not have a high yield, it earns points for stability. Firms in this fund need to increase dividends for 10 consecutive years, which limits exposure to more-cyclical industries. Firms with strong brand names and stable repeat businesses are often able to consistently grow dividends. Thus, it is little wonder that firms like  McDonald's (MCD),

McDonald's (MCD),  Coca-Cola (KO), and

Coca-Cola (KO), and  Procter & Gamble (PG) make the list.

Procter & Gamble (PG) make the list. iShares High Dividend Equity (HDV)

(Morningstar licenses HDV's index to BlackRock and earns asset-based fees.) This is another 2011 new launch that has quickly gained assets, but it is still much smaller than iShares' other dividend-focused fund,

iShares High Dividend Equity (HDV)

(Morningstar licenses HDV's index to BlackRock and earns asset-based fees.) This is another 2011 new launch that has quickly gained assets, but it is still much smaller than iShares' other dividend-focused fund,  iShares Dow Jones Select Dividend Index (DVY). HDV screens for high-yielding stocks that pass both qualitative and quantitative tests for stability. This results in a high yield without sacrificing quality.Not all of the funds we like sport attractive yields, but investors need to remember that the higher the yield, the higher the risk. Instead, we prefer funds take steps to insure quality stocks and mitigate stock-specific risks. We would avoid high-yielding funds with abnormal sector concentration. For example, DVY had nearly 50% of its assets in financial stocks in 2007, right before the financial crisis. Defensive sectors such as consumer staples and utilities have outperformed the market over the past year and are no longer attractively priced. The stocks in

iShares Dow Jones Select Dividend Index (DVY). HDV screens for high-yielding stocks that pass both qualitative and quantitative tests for stability. This results in a high yield without sacrificing quality.Not all of the funds we like sport attractive yields, but investors need to remember that the higher the yield, the higher the risk. Instead, we prefer funds take steps to insure quality stocks and mitigate stock-specific risks. We would avoid high-yielding funds with abnormal sector concentration. For example, DVY had nearly 50% of its assets in financial stocks in 2007, right before the financial crisis. Defensive sectors such as consumer staples and utilities have outperformed the market over the past year and are no longer attractively priced. The stocks in  Utilities Sector SPDR (XLU) offer a 4.1% yield, but our analysts feel that utilities stocks are currently fairly priced, offering little downside protection compared with the rest of the market, which is priced at about 83% of fair value.In the table below, I show the portfolio dividend yield rather than the 12-month yield because HDV has not existed for a full 12 months. The 12-month yield reflects total cash paid out by the fund over the past year, so it requires a full year of data, and cash flows are net of expenses. Portfolio dividend yield is the weighted average yield of the stocks in the portfolio. Data through 11/30/11.

Utilities Sector SPDR (XLU) offer a 4.1% yield, but our analysts feel that utilities stocks are currently fairly priced, offering little downside protection compared with the rest of the market, which is priced at about 83% of fair value.In the table below, I show the portfolio dividend yield rather than the 12-month yield because HDV has not existed for a full 12 months. The 12-month yield reflects total cash paid out by the fund over the past year, so it requires a full year of data, and cash flows are net of expenses. Portfolio dividend yield is the weighted average yield of the stocks in the portfolio. Data through 11/30/11.

Source: Kenneth FrenchStocks are reasonably priced relative to bonds. In the four years prior to the start of the financial crisis in October 2007, investors poured $875 billion into stock exchange-traded funds and mutual funds. Stock funds captured 50% of each dollar invested. But in the four years since, investors have avoided stock funds, instead putting 98% of all fund flows into bond funds. That severe risk aversion has led stocks to appear attractive relative to bonds. In fact, the yield differential between the 10-year government bond and the dividend yield on the S&P 500 has not been this attractive since the 1950s. At that time, we were coming out of a period in which the Federal Reserve pegged interest rates at artificially low levels to help the government fund World War II. In the 30 years prior to 1980, the S&P 500 returned 6% per year after inflation compared with negative 2% from long-term government bonds.

Source: Kenneth FrenchStocks are reasonably priced relative to bonds. In the four years prior to the start of the financial crisis in October 2007, investors poured $875 billion into stock exchange-traded funds and mutual funds. Stock funds captured 50% of each dollar invested. But in the four years since, investors have avoided stock funds, instead putting 98% of all fund flows into bond funds. That severe risk aversion has led stocks to appear attractive relative to bonds. In fact, the yield differential between the 10-year government bond and the dividend yield on the S&P 500 has not been this attractive since the 1950s. At that time, we were coming out of a period in which the Federal Reserve pegged interest rates at artificially low levels to help the government fund World War II. In the 30 years prior to 1980, the S&P 500 returned 6% per year after inflation compared with negative 2% from long-term government bonds. Source: Morningstar AnalystsWithin stocks, we prefer large-cap and low-risk stocks to smaller-cap or pricier stocks. Economic growth will likely remain subpar, so we want to avoid high beta stocks and those pricing in an expectation for rapid growth. But even with slow growth, dividend-paying stocks should be able to maintain their payouts. Payout ratios are below their historical average, so firms could boost payouts to maintain the dollar amount of payouts. In addition, firms have built a sizable cash buffer, which could be used to increase payments. Companies in the S&P 500 have cash equivalent to $296 per index unit, compared with an index level of 1,250. Net debt per unit has dropped from $1,058 at the end of 2007 to $470 today. In other words, if we enter another recession, companies are much better prepared to handle it.With that investment thesis in mind, here are some of the funds that we recommend as well as a few high-yielding funds we might avoid.

Source: Morningstar AnalystsWithin stocks, we prefer large-cap and low-risk stocks to smaller-cap or pricier stocks. Economic growth will likely remain subpar, so we want to avoid high beta stocks and those pricing in an expectation for rapid growth. But even with slow growth, dividend-paying stocks should be able to maintain their payouts. Payout ratios are below their historical average, so firms could boost payouts to maintain the dollar amount of payouts. In addition, firms have built a sizable cash buffer, which could be used to increase payments. Companies in the S&P 500 have cash equivalent to $296 per index unit, compared with an index level of 1,250. Net debt per unit has dropped from $1,058 at the end of 2007 to $470 today. In other words, if we enter another recession, companies are much better prepared to handle it.With that investment thesis in mind, here are some of the funds that we recommend as well as a few high-yielding funds we might avoid. Expense Ratio

Portfolio Yield

S&P 500

NA

2.27

沒有留言:

張貼留言